Blog

Amplification

Robinhood's GameStop Debacle: A Cautionary PR Tale

Did you hear that? The frenzied BUZZ, WOOSH and CHA-CHING’s floating through the internet air? That was the sound of millions of people making billions of dollars (collectively) over the last week of January. Then February rolled around and a lot of that money went POOF.

Buckle up for a retelling of how Reddit used GameStop to cause a Wall Street ruckus and how seven years of Robinhood goodwill crumbled in a day.

Setting the Stage

In 2013, Vlad Tenev and Baiju Bhatt launched Robinhood, an investing app sporting a slick user interface, with the intent to “provide everyone with access to the financial markets, not just the wealthy.”

Their motto? “Democratizing finance for all.”

Fast-forward seven years and one pandemic later—millions of people are stuck at home, screen time increases by like 1,000% and in comes Robinhood. All of a sudden, with a few swipes, anyone and their mothers can take a crack at trading stocks.

The Rise of the People!

Seizing on this opportunity, a ragtag group of retail investors started game planning to make millions off the stock market under the subreddit r/WallStreetBets. In late January, this merry band of about two million decided to throw their money behind GameStop, a videogame store with strong whiffs of Millennial nostalgia.

Citing mantras like "diamond hands" 💎🙌 (holding stocks) and YOLO-ing (investing your life savings), the WallStreetBets community dumped hefty amounts of cash into GameStop ($GME) in an attempt to take their profits “to the moon" 🚀🚀🚀.

This uninhibited optimism in GameStop caused the stock to jump from under $20 to over $100.

Big investment companies that were already locked into short-selling $GME knew there was no great reason for the stock to be this high. So while the public was buying, they waited anxiously for everything to come crashing back down to earth, in hopes of making their big-wig hedge funds a ton of “tendies” (chicken tenders/money).

WallStreetBets found out about these short sellers, pulled a capital flex and drove the price up to nearly $500 in the biggest game of financial chicken in recent memory. All of a sudden, ordinary people were making a lot of money. Like A LOT A LOT.

Let’s recap:

Normal people were making a ton of money betting on GameStop.

Hedge funds were losing a ton of money (BILLION$) betting against GameStop.

Robinhood was the intermediary, living up to its name as the people’s champ.

The Fall of the People

With “normies” like you and me making bank on GameStop, the world was quickly transforming into a hyped-up scene from The Wolf of Wall Street. In the words of WallStreetBets, “Stonks only go up!”

Then Robinhood shut down trading.

Yep. You read that right. At the peak of the GameStop madness, Robinhood turned off the ability to buy $GME and nobody knew why. All you could do was sell.

The stock tanked. Dropping from nearly $500 to below $100. Without warning, the majority of people were losing thousands on thousands on thousands of dollars while the hedge funds covered their losses.

It seemed Robinhood, once the app for the people, was now firmly in the pocket of Big Money. Little guys be damned.

The Fall of Robinhood

Within hours, public sentiment for Robinhood plummeted. Lawsuits flew in left and right. Celebrities like Jon Stewart, Mark Cuban and even the Wolf of Wall Street himself proclaimed disdain for the trading platform. It wasn’t good.

Tenev, Robinhood’s CEO, went on a whiplash press tour to defend his company’s trade bans on these red-hot stocks, but his slow reaction time, unclear reasoning and settling public assumptions only hurt the brand further.

Like Warren Buffet said, “It takes 20 years to build a reputation and five minutes to ruin it.”

For Robinhood, seven years of building confidence torn down in one day.

What’s a reputation implosion like this look like? It looks like a flood of reviews causing a one-star app rating. It looks like thousands of people closing their accounts and bouncing over to competitors like Webull, Public and SoFi. It looks like shelving your IPO to deal with the fallout. It looks like WallStreetBets, a community that grew from 2 million to 8 million in two weeks and caused this whole frenzy in the first place, practically disowning your entire existence.

Good luck to their Super Bowl ad.

Here’s the deal—Robinhood is probably going to stick around. It still has millions of users and plenty of funding. But according to one Facebook employee, “Robinhood is the next Facebook. Something tons of people will use but has a negative undertone and brand.”

That’s the effect of a single day.

A Lesson In Honest Clarity

As the ripple effects of the Robinhood fallout continue to emanate, it should be noted that the real reason for the trading stop was because Robinhood didn’t have enough money to handle the number of trades that were occurring.

It backed up this claim in a blog and a letter to its community after the outrage began.

But those came later.

When it mattered most, in the moment, as people saw their money disintegrate into nothing, Robinhood released this …

… an ambiguous tweet and a blog that doubled down on helping educate users on how the market works, not why individual investors were cut off.

As of writing this, that tweet has received 8,500 likes, 29,100 retweets and 69,700 responses. Twitter rule of thumb: Typically, when a tweet receives way more responses than likes, that’s called getting ratio’d, and it means the people are angry.

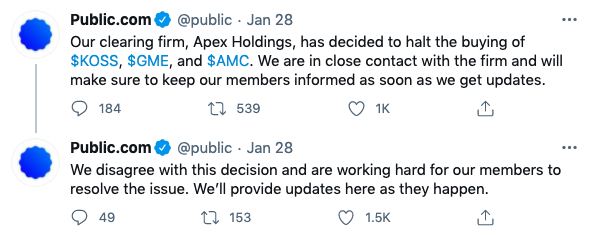

Robinhood wasn’t the only trading app that hit pause, but others communicated what was happening more clearly. They let the people know.

In the digital age, a slow, unclear response can spell death by popular opinion. So what are the PR lessons here?

Spinning up dust as you try to figure out your game plan is a surefire way to bury yourself deep in the dredges of public discourse, especially when money is on the line.

Honest, clear communication, though it may hurt, is the one true way to find your footing. And although it won’t solve every problem, compared to the path of murky half-truths and sidesteps, it leaves little room to fall further than you already are.

In the case of Robinhood, they weren’t willing to let the people know what was going on, instead leaving users to sit wide-eyed in furious confusion as the big guys won and the little guys lost. The result was a brand reckoning that could take years to clean up.

All right, last words:

When a situation arises, be ready. Know what you’re going to say and don't stray. It could mean the difference between becoming a beloved do-gooder or a detestable foe.

Michael McGinnis

Mike McGinnis is DS+CO’s content manager and social media enthusiast with a proven record of creating big ideas that generate real impact.