Blog

Financial Services

AI-powered banking hinges on how well you know your customer

From paper checks to ATMs, debit cards to ACH, the financial services industry has spent the past 60+ years continuously evolving the customer experience. Advancements in technology have shaped new attitudes, behaviors and expectations around how people manage money, forcing banks to adapt again and again.

And today, as artificial intelligence (AI) continues to prove its power across businesses of all sizes and sectors, banking is at a new inflection point in its long history. Financial institutions are under increasing pressure to provide personalized experiences across channels (in-branch, online and mobile), securely and at-scale. This is where the true value of AI resides, and the potential it holds for the future of banking is nothing short of staggering.

Banking is among the industries that stand to create the largest value from AI technology, with the potential of unlocking $1 trillion each year. —McKinsey & Company, 2021

The age of (artificial) intelligence

In 2016, the 18-time world champion of the Chinese board game Go was defeated by Google DeepMind’s AI program, AlphaGo. Because the game requires a mix of creativity, strategic thinking and intuition—intrinsically human skills—the machine’s surprising victory marked one of the first key milestones in AI development.

AI is already at work in the digital banking landscape, from facial recognition to chat bots to voice assistants. From a security and compliance standpoint, AI tools assess risk, detect and prevent fraud, and even perform regulatory checks. But one of the more compelling use cases for AI in retail banking lies in the ability to create personalized product bundles for customers, informed by multiple data sets and sources.

Banking reimagined

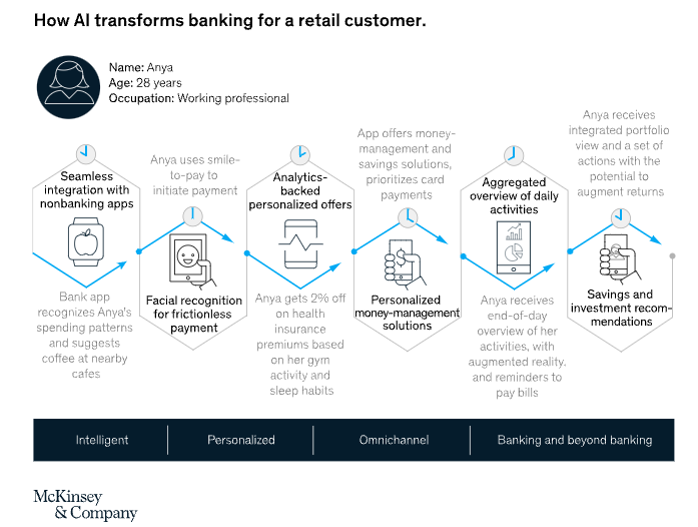

McKinsey & Company published this example of AI in action for a fictional customer named Anya. The depiction below shows how customized Anya’s banking experience is to her needs and preferences. Sure, it can base some of its recommendations on Anya’s age and occupation, but AI’s ability to micro-segment customers at a granular level allows the bank to communicate and market to Anya as an individual. It can make informed suggestions based on her digital activity and recommend products that align with her search queries, past purchases and life stage.

Personalization vs. privacy

Many consumers today are torn between the desire for personalized web experiences (think Amazon’s “you may also like” selection of products) and the discomfort of giving away too much personal information. Yet banks are generally regarded as trustworthy when it comes to safeguarding proprietary data. This established trust opens the door to new opportunities for banks to make ethical use of the data they have in order to better serve their customers.

Take Gen Z, for instance, which represents the next generation of banking consumers. Who have never known a world without a miniaturized computer in their pocket. Whose wealth is expected to increase by more than 70% in the next five years. This generation is already wielding its purchasing power by rewarding banks that can provide personalization and ease across all channels. They want to be shown that you know who they are and what they value.

“To support this, banks need to analyze customer data in real time and embed analytical outcomes within customer journeys for fast execution of customer transaction requests and service queries, enabling instant fulfilment.” —McKinsey & Company, 2021

This kind of intelligence goes beyond segmentation studies and into deep market research and analysis that starts to poke at belief systems, mental models and life experiences—a constellation of factors that make us who we are. And which can be helpful when crafting a contextually relevant message or offer.

Take a look at the example below, how McKinsey & Company visualizes the new banking experience from a business-level standpoint.

Digital marketing will play a critical role in the AI-enabled bank of the future

The opportunities AI can bring to banking are seemingly endless. Success, however, will likely hinge on the company's commitment to knowing and understanding its customers.

To anticipate their needs, communicate with empathy and build trust. This is where marketing intelligence, strategy and amplification can step in to translate a wealth of data into an omnichannel, human banking experience that feels purposeful, personal and seamless. Through qualitative and quantitative studies, surveys and search engine analysis, banks can learn a whole lot about their customers and their communities. What inspires them, what motivates them, what scares them, what resonates with them.

It’s a tall order. But as the world saw in the now infamous AlphaGo defeat, AI plays to win.

For more of the latest insights in financial services marketing, sign up for our newsletter today.

Malorie Benjamin

Malorie knows media, inside and out. Since first joining the marketing world, she’s made it her mission to stay on top of the latest advancements and advocate for how people are interacting with technology—no matter the channel or media type. It’s part of her deep love of data, which she knows is the key to a successful campaign. But her real source of pride comes from building the media team here at DS+CO into a curious group that, like her, are committed to evolving with the market and using their expertise to influence sound strategy.